‘Do things tomorrow that no one can do today’: Inside Publicis’s €300m AI bet

The French holding company has unveiled a major AI investment. We speak to execs Nigel Vaz and Carla Serrano about what it hopes to achieve.

Publicis say is spending over $320m building a bespoke AI system / Publicis

After a year of hype among executives – and apprehension among their staff – advertising’s embrace of artificial intelligence is only speeding up. Publicis Groupe, one of the world’s largest ad agency groups, is due to spend €300m ($326m) over the next three years developing a native AI solution.

According to chief executive Arthur Sadoun, the investment will make its people “more efficient and more productive… more importantly, it will allow everyone to do things tomorrow that no one can do today, guided by the highest ethical standards and at the service of clients’ growth.”

Explore frequently asked questions

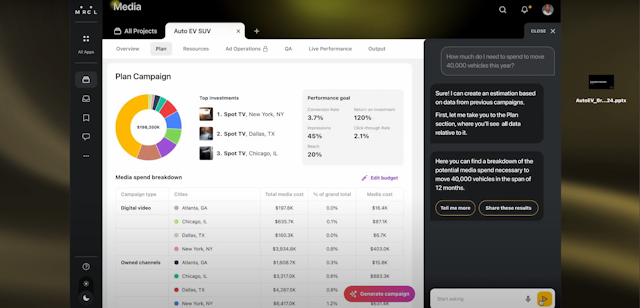

In an hour-long video presentation recorded for shareholders and clients, Sadoun says that ‘CoreAI’ would be a single user interface (UI) that would combine existing third-party AI tools, bespoke application and a means for staff to access proprietary Publicis data on audiences and its entire creative asset library.

Publicis owns agencies such as Saatchi & Saatchi, Conseil, Le Pub, Starcom and Zenith and employs around 100,000 staff worldwide. In the presentation, Sadoun and other executives from the company’s top team show off early versions of the CoreAI system, with early case studies of features intended to aid media planning and buying, creative ideation, production and strategy and consulting work.

Advertisement

Demonstrations featured in the presentation claim that weeks’ worth of research can be condensed to mere seconds or that tedious email exchanges required to discover prospective client conflicts resolve automatically. Sadoun promised that staffers at each of those agencies would be able to use the system to access strategic data, creative assets and audience datasets from the group’s entire client portfolio.

In one demo, the job of filling in up-to-date info on the company’s capabilities for a client request for proposal (RFP) is performed by an ‘RFP generator’ based on a database of past Publicis RFPs.

The company also hopes the system will make its backroom operations more efficient. According to Publicis Sapient chief executive officer Nigel Vaz, the group expects to begin seeing modest benefits to its operating margin from 2025 onwards.

“We’ll start to see some of the benefits that we gain this year, start to improve our operating margin next year, and the years after,” he tells The Drum.

€300m on Publicis Groupe’s next ‘bet’

The cash Publicis has put aside for CoreAI – $326m over the next three years – is a significant investment in the technology, several times larger than what the holding company might typically spend acquiring an agency.

Sadoun’s video address places it on par with earlier “strategic bets,” such as the holdco’s shift to a country model and single P&L. Excluding some of last year’s bigger AI-motivated agency acquisitions, such as Omnicom’s deal for Flywheel or Brandtech’s acquisition of Pencil, it’s perhaps the single largest investment in AI yet made by a marketing services group.

“Everyone’s talking about AI… we wanted to set the record straight,” says Publicis Groupe chief strategist Carla Serrano. “It’s easy to see AI as a cost-efficiency play or automation play, but you only see the benefit of it as a growth accelerator if you’re already connected.”

Advertisement

In the presentation, Sadoun says the company plans to fund CoreAI directly from profits and “internal efficiencies.” A third of that investment will play out in 2024, with €50m (£54.3m) going towards AI-specific training and development of staff and €50m on tech investments such as Nvidia chips.

Vaz says that won’t lead to a travel freeze or pay freeze for Publicis staff or a repeat of 2018’s Cannes boycott – a measure Publicis enacted in order to pay for its then-new Marcel HR software. “Other technology investments we were making, all the partnerships we were doing… we’re putting [that] money towards this. We’re prioritizing this from an investment perspective across every business,” he says.

In the long term, Publicis executives hope the technology will fundamentally change its media-buying, creative, strategy and digital consulting businesses.

In the video presentation, Sadoun says the investment will turn Publicis from a holding company into an “intelligent system company,” enabling its staff to draw from ideas across its organization.

“Each individual in the group will have access to everything we know at Publicis on every expertise and every geography. To cut a long story short, we are bringing the power of everyone to the power of one,” he says.

Suggested newsletters for you

With AI set to become an important market differentiator between rival agencies (a recent survey from marketing consultancy Boathouse estimated 58% of CMOs asked for funding to pursue AI initiatives last year), Sadoun believes CoreAI can make Publicis more competitive.

”By starting first with a unique model built over the last decade, we are confident that we can leapfrog the market once again and continue not only to deliver the best margin in the industry but continue growing faster than our peers in years to come.”

Small language models and Nvidia chips

CoreAI is set to incorporate the use of large and small language models as part of a “singular modular tech platform.” The idea is that staffers could use CoreAI to create a bespoke training model specific to a given client; because Publicis could ensure that a model is only trained on data it or its client owns, it could sidestep concerns around sample bias and copyright ownership currently holding advertiser investment in AI back.

According to Vaz, CoreAI is also set to include AI tech from major players such as OpenAI, Microsoft, Google, Adobe, Hugging Face, Runway, Midjourney, Stability (which makes Stable Diffusion) and Meta. “They’re all part of this model hub, which allows us to pick and choose what model we want to deploy,” he says.

Unlike public usage of tools such as ChatGPT, data from CoreAI won’t go back to those firms, though. “OpenAI models don’t get smarter on the basis of our data. In this instance, our models are smarter on the basis of our data.”

That also allows Publicis to tiptoe around their clients’ own relationships with big tech. “There might be people that work exclusively with Microsoft or Google right now… to be able to work with a full suite of partners is really important to our design,” says Serrano.

The use of smaller training models means Publicis can correct for sample bias and ensure datasets don’t contain some of the racial or social biases seen elsewhere, she argues. “We need a next-level understanding of how [AI] affects different constituents, whether that’s customers or your employees.

“We’re pretty excited about the fact that we may be building a new environment within AI that doesn’t have the legacy of a patriarchal system or a gender bias built in.”

Publicis Sapient, the company’s tech services arm, has been working on CoreAI for around two and a half years, according to boss Vaz, beginning with work on machine learning platform Bodhi. Sapient was relatively early to begin utilizing generative AI tools, with chief marketing officer Teresa Barriera mandating staff experiment with the tech across the firm.

“AI has been core to us since we built Marcel,” says Vaz. “We were starting to build large components of this in the context of Bodhi around two years ago… and then last year, when we started to talk about how AI was going to shape and transform the shape of our business, we started to have conversations about what we felt that meant for us.”

The company leaned on an existing partnership with chipmaker Nvidia to procure a supply of bespoke chips – expensive physical hardware essential for the running of high-powered AI software – for the initiative.

Amid the rush of investment from corporations in AI development, Nvidia GPU chips are in high demand – so much so that Meta announced it was spending billions of dollars stockpiling the kit.

“Sapient partners with Nvidia on the design of the chips themselves. Some of the costs are going to go toward Nvidia, but from an availability perspective, we’ve had lots of time to forecast the kind of demand we’ll have for early use cases and we’re well covered,” says Vaz.

According to Vaz, a handful of features are already at an alpha testing stage. Demos of the first beta-ready features are expected in May, with a beta program due in the fourth quarter of this year. He says the company is prioritizing developing for the US market initially, given that the lion’s share of Publicis’s revenues are generated there. Either way, most staff at Publicis agencies aren’t due to get their hands on a beta of CoreAI until 2025.