Amazon seizes the Prime Day

Raking in record sales this year didn’t require the ecommerce giant to divert from its tried and true playbook.

Prime Day 2024 generated record sales for the ecommerce titan / Adobe Stock

Amazon’s 10th annual Prime Day illustrated how commandingly the retail giant runs the show of ’Christmas in July’ for American consumers. And the retail giant’s outsize influence on ecommerce is extending further throughout the year, thanks to a proliferation of new sales events designed to spur more frequent purchases, drawing both shoppers and advertisers deeper into the Amazon ecosystem.

The company reported another record-breaking year for Prime Day sales, though without providing specific figures. Emarketer anticipated that Amazon would hit a new high for US Prime Day sales at $8.18bn over the two days, up 5.5% from 2023.

Explore frequently asked questions

Advertisement

Amazon’s Prime Day sales started strong out the gate as shoppers rushed to score deals before inventory sold out. Momentum Commerce reported a 12% year-over-year increase during the first seven hours of the event.

But according to tracking data from Numerator, spending per household over the two days dropped to $152.33, compared to $181.72 in 2023.

Top sellers during Amazon’s Prime Day aligned with broader consumer spending trends prioritizing smaller-ticket categories such as beauty, household essentials and health and personal care. Deals on Amazon devices and lower-cost consumer devices also resonated with shoppers during the event, as they typically do.

There wasn’t much impressively new in this year’s Prime Day sales, and some complained of lackluster discounts, but these ultimately weren’t necessary. Amazon faced somewhat less competition this week because major retail rivals Walmart and Target, along with newcomers like TikTok Shop, held their big July sales a week earlier – perhaps having relied on the widespread expectation that Amazon would hold Prime Day on July 9-10 this year.

Amazon largely stuck to its established playbook, which is centered around offering compelling-enough deals and a variety of perks to satisfy existing Prime members and drive more signups to its flagship membership program.

Advertisement

And that’s because the power of Amazon is built on the flywheel effects of its Prime membership program. Nearly three-quarters of US households have a paid membership, and yet the number of Prime users is still rising and is projected to reach 185 million in 2025, per Emarketer’s forecast.

Even as they cut back in other areas, American consumers are willing to shell out $139 a year for the reliable benefits of convenience, an enormous product selection and speedy delivery. Nearly 90% of Prime Day 20204 shoppers were members, according to Numerator data, and almost all had shopped Prime Day in the past.

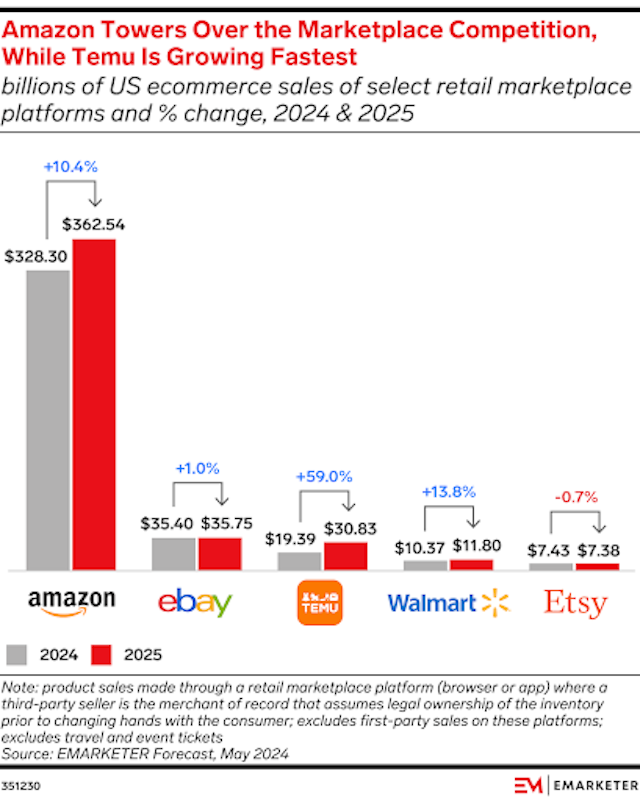

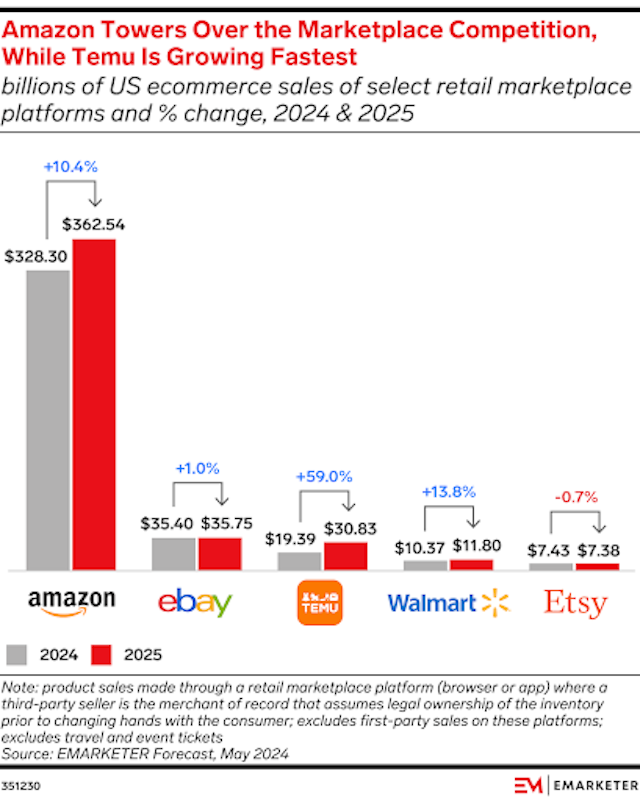

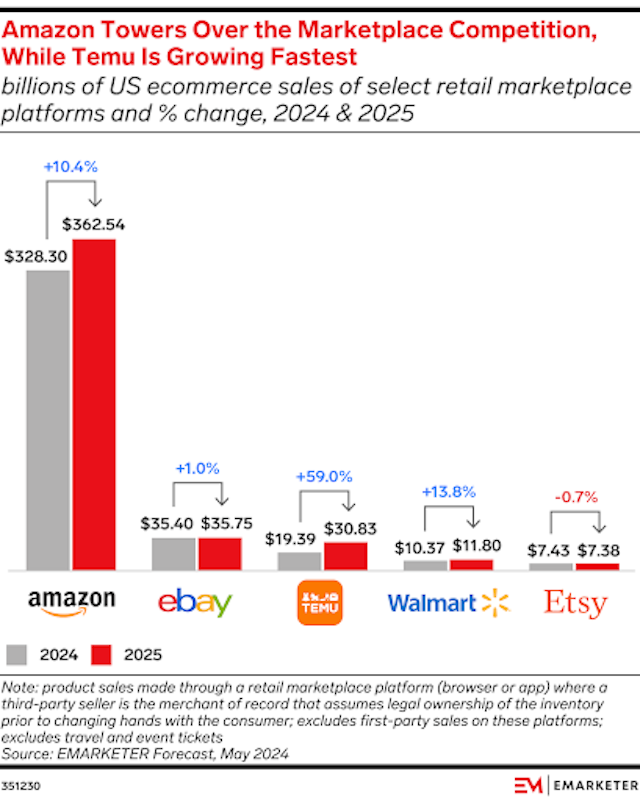

Access to this vast and sticky base of paid members is hugely attractive to brands and sellers, who are the real growth engine for Amazon’s retail business. Amazon’s third-party marketplace now generates more than two-thirds of Amazon’s US gross merchandise value, and it continues to expand. And while Amazon accounts for more than 40% of total US retail ecommerce, it truly towers over the US marketplace space with its 70% share of retail marketplace sales.

Emarketer expects Amazon to maintain this position, even amid fresh competition from newer marketplaces launched by Walmart and Temu that have gained traction among consumers looking for deals. Marketplaces account for around 40% of US ecommerce sales, a smaller share than in many other parts of the world, so there is still a lot of runway for growth.

Suggested newsletters for you

The presence of third-party brands and sellers on the Amazon marketplace fuels a demand for advertising that Amazon has so decisively leveraged to help it target shoppers with highly relevant ads. Amazon will draw more than 77% of US digital retail media ad spending each year through 2026, per Emarketer’s forecast. And that will be no small feat as more players in retail and other industries, such as finance and travel, follow in its footsteps and race to build out ad networks that capitalize on their access to first-party consumer data.

As the marketplace grows, Amazon has somewhat less control over the pricing and discounts offered by independent sellers, and can only exert so much influence before it starts to look anti-competitive.

During Prime Day, brands and sellers must carefully balance the levers of discounts and advertising to achieve their desired outcomes. And new Amazon sales events such as the Big Spring Sale, October Prime Early Access Sale, and category-specific promotional weeks create more opportunities to shape shopper and advertiser behavior. So even if consumers don’t always get the biggest savings, Amazon still comes out way ahead.

For more, sign up for The Drum’s daily newsletter here.